AI in Clinical Trials: Why Investors Are Watching This Space Closely

The use of artificial intelligence in clinical trials is rapidly shifting from experimental to essential. The market for AI in clinical trials is projected to grow at a 12–28% CAGR, with estimates ranging from $1.35–$2.7 billion in 2025 to $3.3–$8.5 billion by 2030. This momentum is driven by AI’s potential to reshape every phase of the trial process—from recruitment to protocol design to outcome monitoring. It’s also a direct response to the inefficiencies of the traditional system: nearly 90% of clinical trials fail to meet their endpoints, and delays in patient recruitment alone can cost sponsors $8 million per day. AI is now seen as a critical lever to improve both the speed and the success rate of trials.

Patient Recruitment Gets a Major AI Boost

One of the most advanced applications of AI in this space is patient recruitment and matching—a notorious pain point in clinical research. New tools are showing real-world results. For example, TrialMatchAI, an open-source LLM-based platform, recently achieved ~92% accuracy in matching patients to relevant oncology trials. Academic efforts like MatchMiner-AI are similarly streamlining the process by integrating trial criteria with structured electronic health record (EHR) data. These platforms directly address one of the largest inefficiencies in drug development: finding the right patients at the right time.

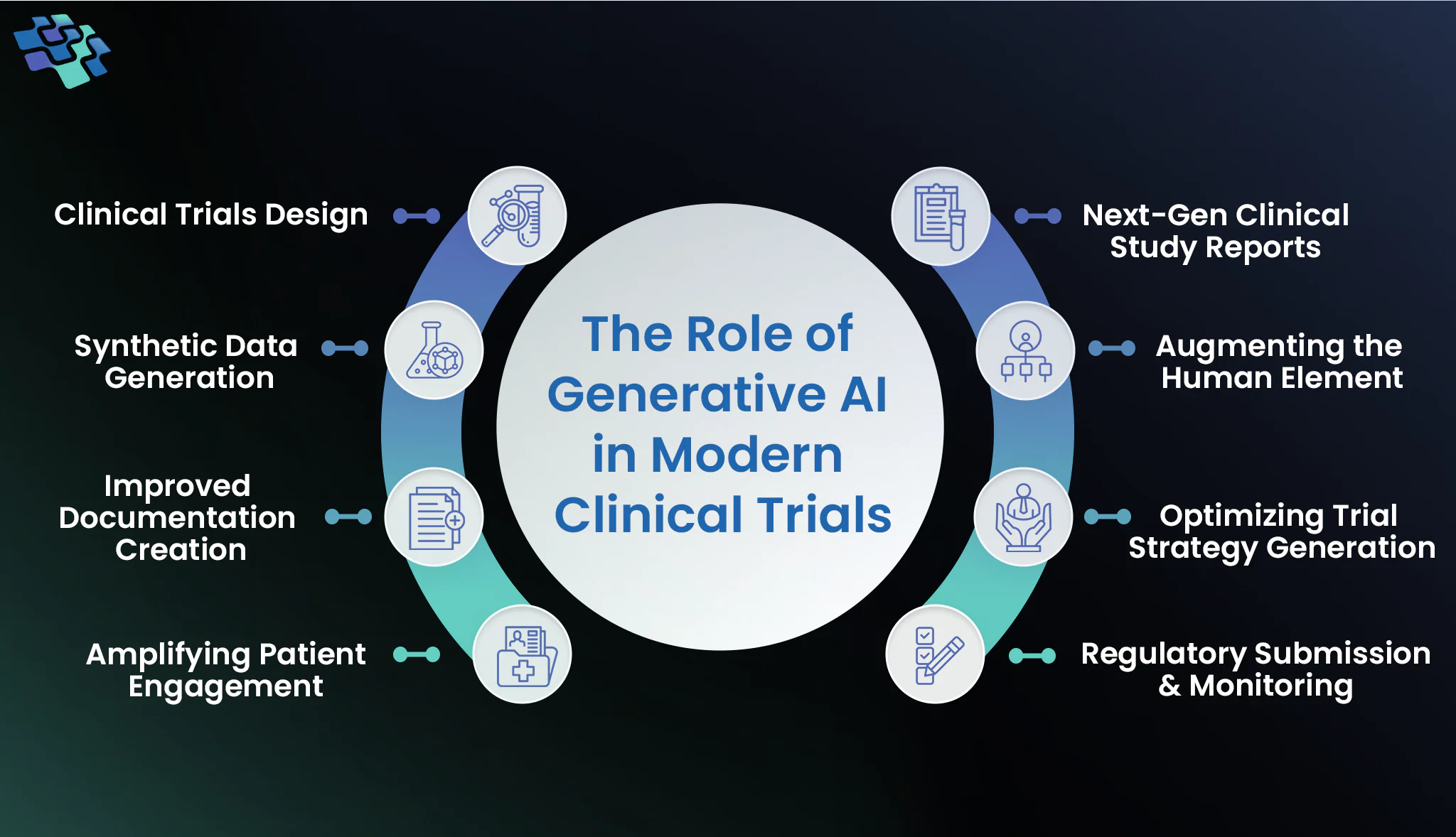

AI is also transforming trial design. Startups like ConcertoAI are introducing AI-driven simulators (such as CTO 2.0) that help sponsors build adaptive protocols with smaller sample sizes and a lower risk of failure. This allows drug developers to predict trial performance before launching, reducing costly mid-trial surprises. Meanwhile, Risk-Based Quality Management (RBQM)—an FDA-supported framework for improving trial oversight—is being supercharged by predictive analytics. AI now enables real-time monitoring of safety and efficacy signals, helping sponsors identify issues early and optimize trial operations dynamically.

AI-Powered Endpoints Are Gaining Regulatory Traction

Regulators are beginning to embrace AI in more pivotal roles. A major milestone this year was the EMA’s approval of AIM-NASH, an AI tool that grades liver biopsy severity in NASH trials with greater consistency than human pathologists. This marks one of the first cases where an AI-based assessment is accepted as a primary endpoint—a breakthrough that paves the way for similar tools across oncology, neurology, and rare disease trials. The adoption of digital biomarkers is also accelerating, as AI models identify novel endpoints from wearable devices, imaging, and multi-omics data.

AI Assistants Are Helping Trial Teams Move Faster

Another fast-moving frontier is AI “scribes” for clinicians and trial teams. Tools like Heidi Health automate documentation and clinical note generation, freeing clinicians to focus more on patient care and trial management. The company recently raised AUD 16.6 million and now processes over 1 million patient interactions per week. As trial complexity grows, AI assistants will become an essential layer of workflow automation—reducing administrative overhead while improving data quality.

Who’s Standing Out?

Several startups are emerging as category leaders. Opyl (ASX:OPL) focuses on AI-powered patient recruitment and protocol design. Owkin, known for its federated learning platform, is partnering with pharma giants like Sanofi, Amgen, and BMS to drive AI-based trial optimization and predictive biomarker discovery. On the big tech front, Alphabet’s Isomorphic Labs just closed a $600 million funding round to expand its AI-driven drug discovery and trial prep capabilities. At the same time, pharma incumbents like Johnson & Johnson, Merck, and Eli Lilly are now training tens of thousands of employees to adopt AI in regulatory writing, trial optimization, and beyond.

VC and M&A Activity: A Surge of Interest

Within AI health-tech, companies like Lindus, Latent Labs, and Quibim all raised significant rounds north of $50 million this year. Heidi Health’s Series A round is another signal of growing investor appetite for operational AI in clinical trials.

M&A is also heating up. AMD recently invested $20 million in Absci (AI-driven drug discovery). Strategic buyers—especially CROs (contract research organizations), big data players, and large biopharma firms—are now targeting startups that can bring AI-powered recruitment, trial simulation, and regulatory-grade analytics into their ecosystems.

What’s Next: Where AI in Trials Is Headed

In the next 2–3 years, we expect AI-augmented trial design to become standard across both large pharma and nimble biotech. Trial simulators and AI-generated protocols will help sponsors de-risk early-stage trials. Privacy-preserving federated learning tools (like Owkin’s) will gain traction amid rising concerns about data security. On the regulatory front, more AI-driven endpoints will receive EMA and FDA validation, creating a clearer path for clinical adoption. Meanwhile, LLM automation will expand into scheduling, monitoring, and clinical documentation.

From an investment standpoint, M&A activity is poised to accelerate in 2026–2027, with CROs and pharma companies likely to acquire AI platforms that can seamlessly integrate into existing trial workflows. Capabilities like federated learning, LLM-based trial assistants, and predictive quality management will be among the most attractive targets.

AI is no longer a future bet in clinical trials—it’s an emerging standard. For investors, the space offers a compelling opportunity to back platforms that will embed AI deeply into trial operations. With regulatory signals turning favorable and VC interest running high, the next wave of value creation will come from companies that can scale beyond innovation and become the connective tissue of modern clinical research.

—————————————–

If you are a builder, investor or researcher in the space and would like to have a chat – please reach out to me at amit.k@thelotuscapital.com